Creditors today face a number of challenges with regards to collecting outstanding debt from their customers, in particular when vulnerability has been identified.

Identifying and dealing with vulnerability requires specialist skills, knowledge and experience, and a failure to act appropriately (or at all) can cause significant harm, not just to the person in debt. |

More so now than ever, the standard approach to debt recovery will not be appropriate for vulnerable consumers.

But there is a better way...

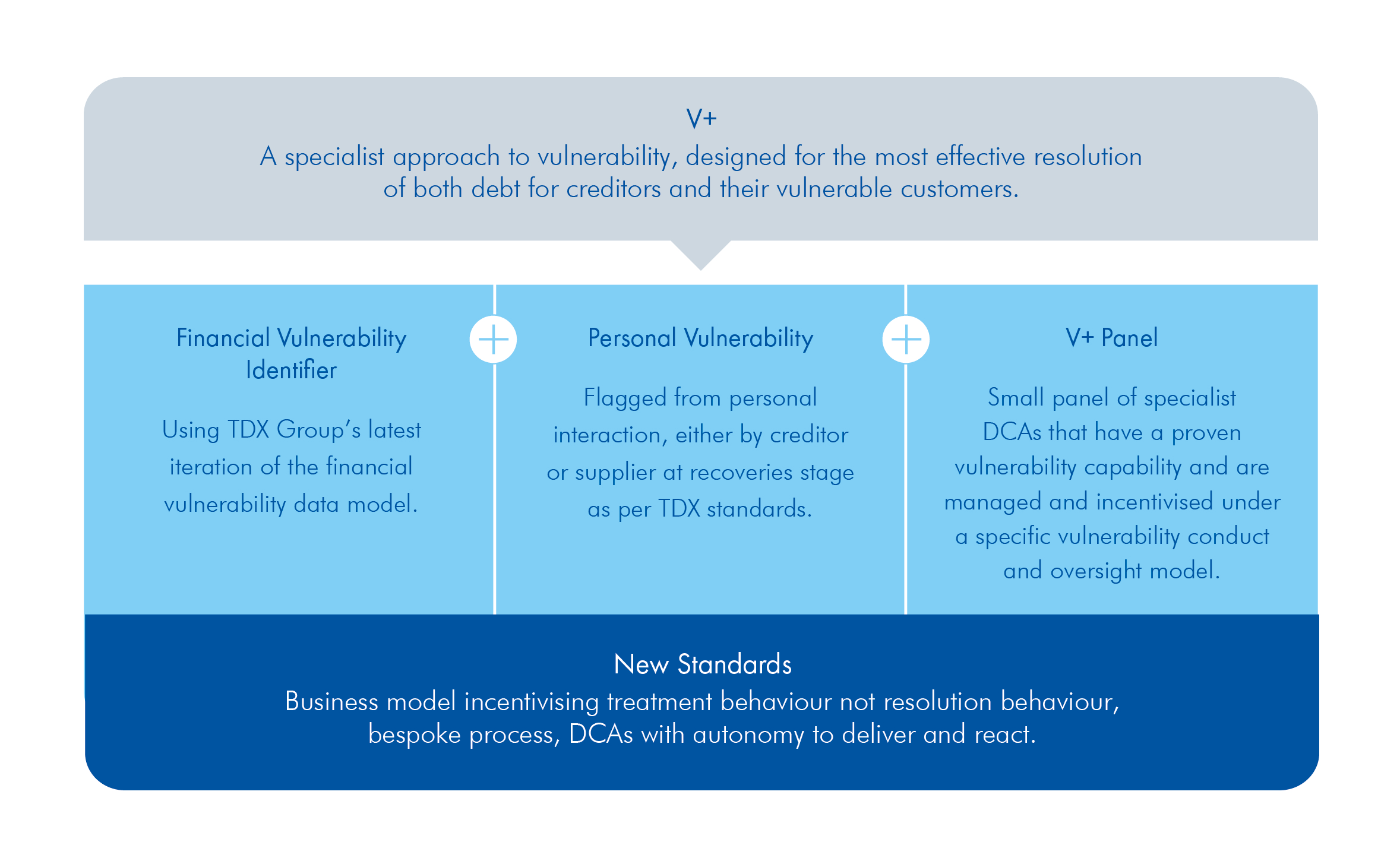

V+ is a thorough, more effective way to identify, manage and treat vulnerable consumers in debt. |

Earlier and better identification and treatment of vulnerable consumers improves the customer experience and outcomes as it give them the opportunity to engage and resolve the situation. This human approach to vulnerability works because our V+ panel are empowered and equipped to work flexibly with people in debt to achieve the right outcome for their individual situation. By dealing with vulnerable consumers more appropriately, we have the opportunity to change people's lives for the better.

Carlos Osorio, Director of Debt Recovery at TDX Group

With V+ we help creditors

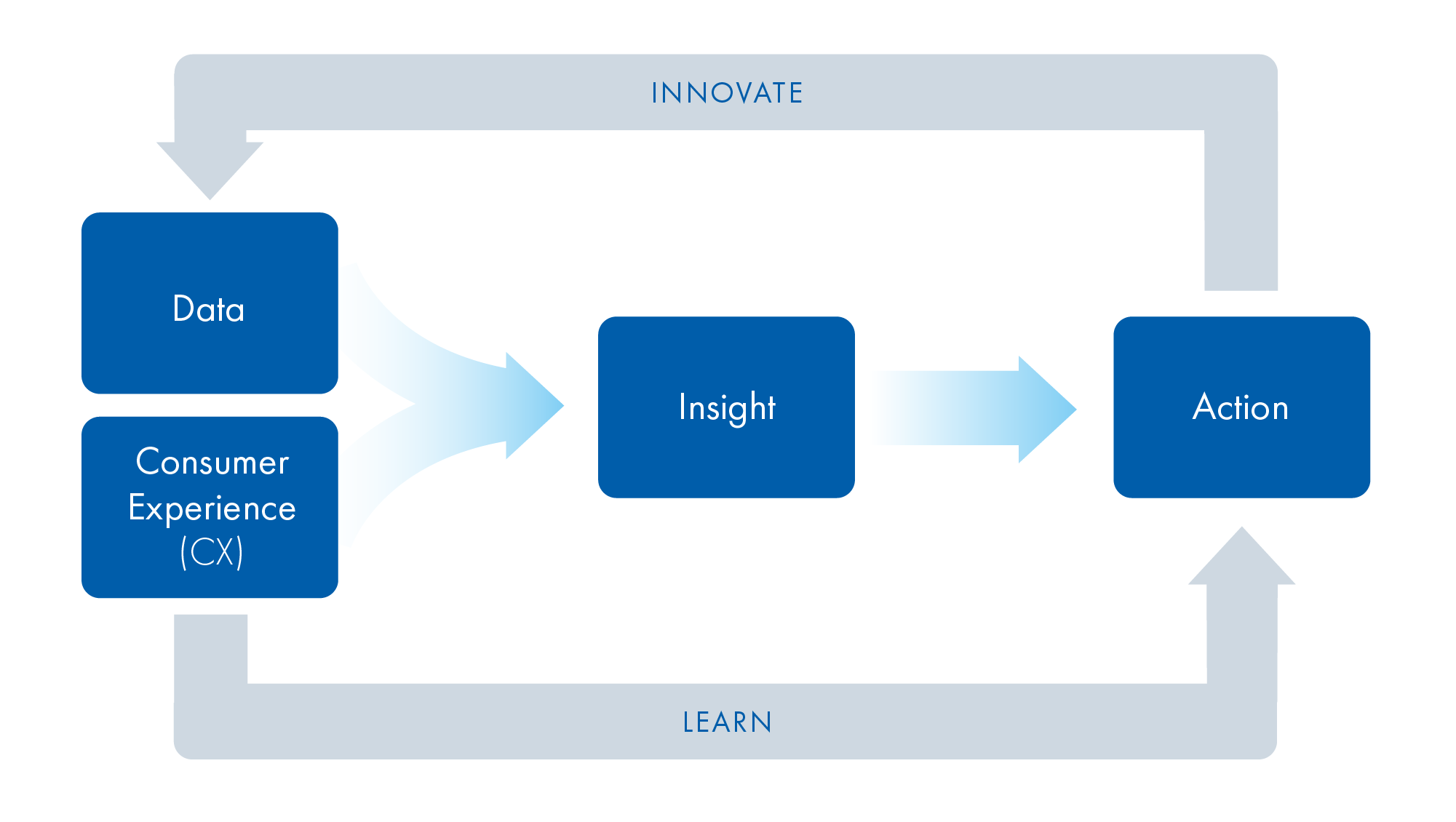

We take a diffferent approach to vulnerability

Data

Data

TDX Group is an Equifax company, so we're small enough to move fast, and big enough to get things done. We use Equifax data and blend with additional data from a variety of sources for the most accurate market leading insights.

CX

Our panel of Debt Collection Agencies is the largest in the UK, and our rigorous conduct and oversight framework gives us unique insight into both collections activity and consumer behaviour. This ensures our services are designed with consumers in mind.

Insight

Advanced analytics and a powerful

Financial Vulnerability Identifier helps us accurately identify vulnerability and segment your customers in order to apply the most appropriate treatment.

Action

Treatment of vulnerable consumers is through the

V+ Panel, a small, specialist and specially selected subset of our DCA panel. They are uniquely qualified to deal with all types of vulnerability. The language of all communications is tailored appropriately and delivered via the recipient’s preferred contact channels and remuneration is linked to fair treatment of consumers.

Debt is not impossible to collect from vulnerable consumers, it just requires a different approach

What is V+?

.

.

Why do we need a different approach?

|

- Better identification and treatment of vulnerable consumers in debt helps creditors meet (or exceed, in this case) regulatory requirements

- Improves debt resolution vs conventional treatment paths

- Appropriate treatment drastically improves the consumer experience

- Supports long lasting positive relationships between consumers and brands

|

“The biggest success story is that recoveries and the amount of money collected from the vulnerable people has increased significantly. Because they weren't ready to pay at day 5 or day 10 in a collections world, but they are ready to pay after 4 months or 5 months being treated like a proper human.

Graham Rankin, CEO at BPO Respect (Debt Collection Agency on TDX Group’s V+ Panel)

V+ can be most helpful to companies that:

- Have identified vulnerability but are unsure if they are equipped to deal with it or are nervous around the regulatory risk and sensitivity of collecting debt from the vulnerable

- Want a more rigorous and effective approach to identifying vulnerability and collecting debt from this segment of customers so they can demonstrate they are treating customers fairly

- Have placed customers through a regular collections process and analysis suggests that the V+ approach could improve upon this outcome

Download Brochure

What is debt sale?